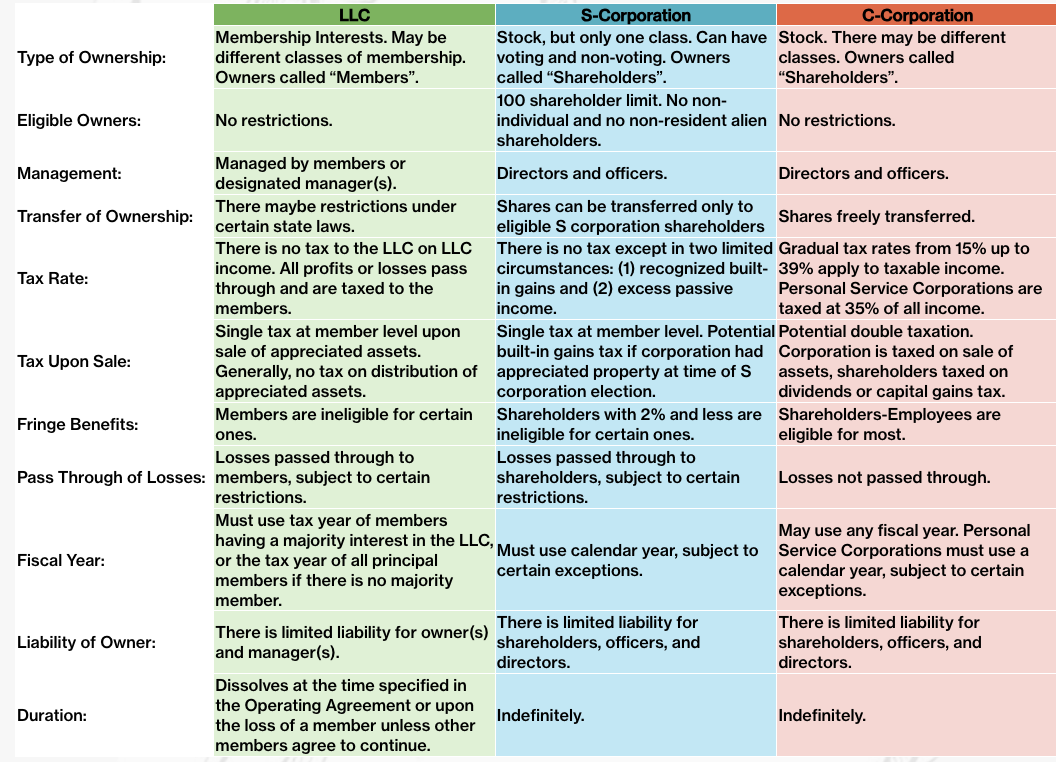

The following table gives a side-by-side comparison of 3 most common forms of business organization: C-Corporation, S-Corporation, and LLC (Limited Liability Company):

NOTE: LLC is the most flexible type of business entity thanks to the fact that LLC members can keep the company taxed as partnership (or disregarded entity if single-member LLC, both default forms of taxation), or instead elect it to be taxed as S-Corporation or even C-Corporation, if company owners’ taxation goals work best with these types of taxation.

Any corporation is taxed as C-Corporation by default, and can be elected to be taxed as S-Corporation, provided all shareholders are U.S. persons, etc (read here for a list of requisites for S-Corporation).

In the table below we compare LLC taxed as partnership (or disregarded entity) with corporations taxes as S-Corp and C-Corp respectively.

Comparing Business Entities: LLC vs. C-Corporation

Taxation Differences:

Structural Variances:

Comparing Business Entities: LLC vs. S-Corporation

Income Allocation Distinctions:

Ownership Parameters:

Self-Employment Tax Considerations:

Comparing Business Entities: C-Corporation vs. S-Corporation

Tax Treatment:

Income Allocation Differences:

DISCLAIMER REGARDING LEGAL ADVICE:

This article does not aim to offer tax advice or guidance. None of the information presented on this website should be construed as legal or professional advice, and you should not solely depend on it to make legal determinations. When appropriate, it is advisable to seek the counsel of a qualified attorney for personalized advice tailored to your circumstances.

Connect with our team of experts who are ready to provide you with personalized solutions tailored to your specific needs.

Call us right now

Enterpreneur

Lilly is outstanding to work with, extremely professional, and cares about her clients.

Entrepreneur

Very patient and will walk you step by step to ensure you are well taken care of. I highly recommend THE ARK NPS.

HR Manager

Lilly steps into your business to give you clarity and position you for success.

Manager

Connect with our team of experts who are ready to provide you with personalized solutions tailored to your specific needs.

Our FAQ section provides answers to common questions about our services, fees, team, and how to schedule a consultation, helping our clients make informed decisions about their financial needs.

You can easily schedule a consultation with our firm by clicking on the "Get a Quote" button & the "Appointments Tab" on our website.

Click "Contact Us" for Our experienced tax professionals to get in touch. They can provide comprehensive tax planning and preparation services to help you identify deductions and credits, reduce your tax liability, and maximize your tax savings.

Click the "Get A Quote" button for customized fees. Our fees vary depending on the services you require, the complexity of your situation, and other factors.

We offer competitive pricing and transparent billing practices, and we can provide you with a customized quote based on your specific needs.

Making your mission possible through our financial and leadership expertise.

Gain access to expert tax tips, discounted courses and events, and essential guidelines from us.

Join us for the Summer Business Series and gain valuable insights into hiring, tax strategies, startup essentials, and more to elevate your business success.

Their management consulting services have been instrumental in improving our bottom line.