Our company offers professional business filing services that ensure your company documents and applications are accurately filed and in compliance.

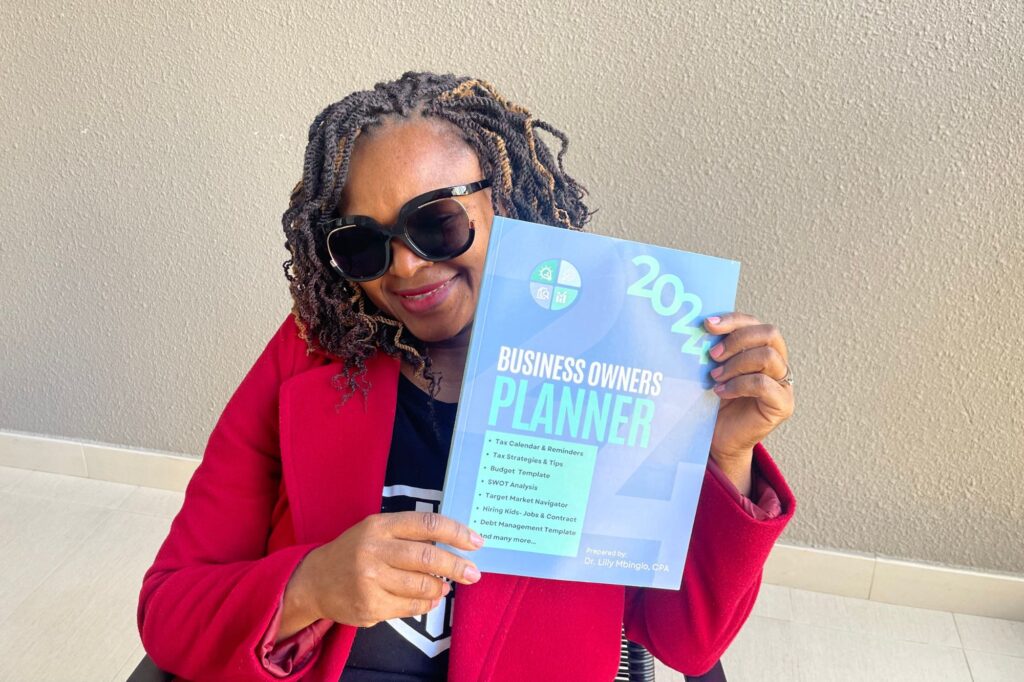

Dr. Lilly Mbinglo, CPA

CEO of THE ARK NPS

Our company offers professional business filing services that ensure your

company documents and applications are accurately filed and in compliance.

A non-profit organization (abbreviated as NPO, also known as a not-for-profit organization) is an organization that does not distribute its excess profits to owners or shareholders, but instead uses them to help pursue its goals.

Non-profit organizations are established for a variety of purposes, most commonly charitable, educational, or religious. Some common examples are schools, hospitals, houses of worship, museums, fraternal organizations, food banks, homeless shelters, trade unions, and other volunteer organizations. Non-profit organizations must be organized as either trusts, associations, or corporations.

Forming your non-profit organization as a corporation, instead of a trust or an association, will offers you all the same benefits as a for-profit corporation. The most significant benefit is limited liability protection for the officers, directors, and shareholders of the corporation, so that their bank accounts, homes, and other personal assets cannot be used to satisfy the debts and liabilities of the non-profit corporation.

The main advantages of a non-profit corporation over a for-profit company are exemptions from State and Federal income tax and property tax (although the exemptions must be applied for separately). There also some other, smaller benefits, such as reduced rates at the U.S. Postal Service.

Unlike for-profit corporations, non-profits cannot distribute any profits to their members, contribute money to political campaigns, or engage in political lobbying, except in very limited circumstances.

Even after a non-profit is formed, the company must observe many formalities and make timely filings with the IRS. Non-profit corporations are required to observe all of the same corporate formalities as their for-profit counterparts, including holding regular meetings of the board of directors and recording the minutes of these meetings.

In addition, non-profit corporations are required to keep books and records detailing all activities, both financial and non-financial. Financial information, particularly information on the sources of support (contributions, grants, sponsorships, and other sources of revenue) is crucial to determining an organization’s private foundation status.

Any non-profit qualified under Section 501(c)(3) exemption must file an annual information return: Form 990, Form 990-EZ, Form 990-PF or Form N-990. Each State also has it’s own filing requirements for non-profit corporations. We recommend consulting an accountant about these filings. Finally, all 501(c)(3) non-profits are required to have a Federal Tax ID (EIN) number, regardless of whether they have any employees.

Connect with our team of experts who are ready to provide you with personalized solutions tailored to your specific needs.

Call us right now

We will prepare and file your Nonprofit application in a professional manner, all you need to do is schedule a meeting with us now.

Please feel free to contact our representatives to guide you via contact us or telephone at +1 (757) 977-8911.

Our company offers professional business filing services that ensure your company documents and applications are accurately filed and in compliance.

At our firm, we prioritize getting to know our clients and their unique visions to provide tailored start-up solutions. Let’s have a conversation and start building a roadmap toward the beginning of your start-up.

Enterpreneur

Lilly is outstanding to work with, extremely professional, and cares about her clients.

Entrepreneur

Very patient and will walk you step by step to ensure you are well taken care of. I highly recommend THE ARK NPS.

HR Manager

Lilly steps into your business to give you clarity and position you for success.

Manager

Connect with our team of experts who are ready to provide you with personalized solutions tailored to your specific needs.

Our FAQ section provides answers to common questions about our services, fees, team, and how to schedule a consultation, helping our clients make informed decisions about their financial needs.

You can easily schedule a consultation with our firm by clicking on the "Get a Quote" button & the "Appointments Tab" on our website.

Click "Contact Us" for Our experienced tax professionals to get in touch. They can provide comprehensive tax planning and preparation services to help you identify deductions and credits, reduce your tax liability, and maximize your tax savings.

Click the "Get A Quote" button for customized fees. Our fees vary depending on the services you require, the complexity of your situation, and other factors.

We offer competitive pricing and transparent billing practices, and we can provide you with a customized quote based on your specific needs.

Making your mission possible through our financial and leadership expertise.

Gain access to expert tax tips, discounted courses and events, and essential guidelines from us.

Join us for the Summer Business Series and gain valuable insights into hiring, tax strategies, startup essentials, and more to elevate your business success.

Their management consulting services have been instrumental in improving our bottom line.